Payment Flexibility: Combining Multiple Methods for Your Cross-Border Checkout

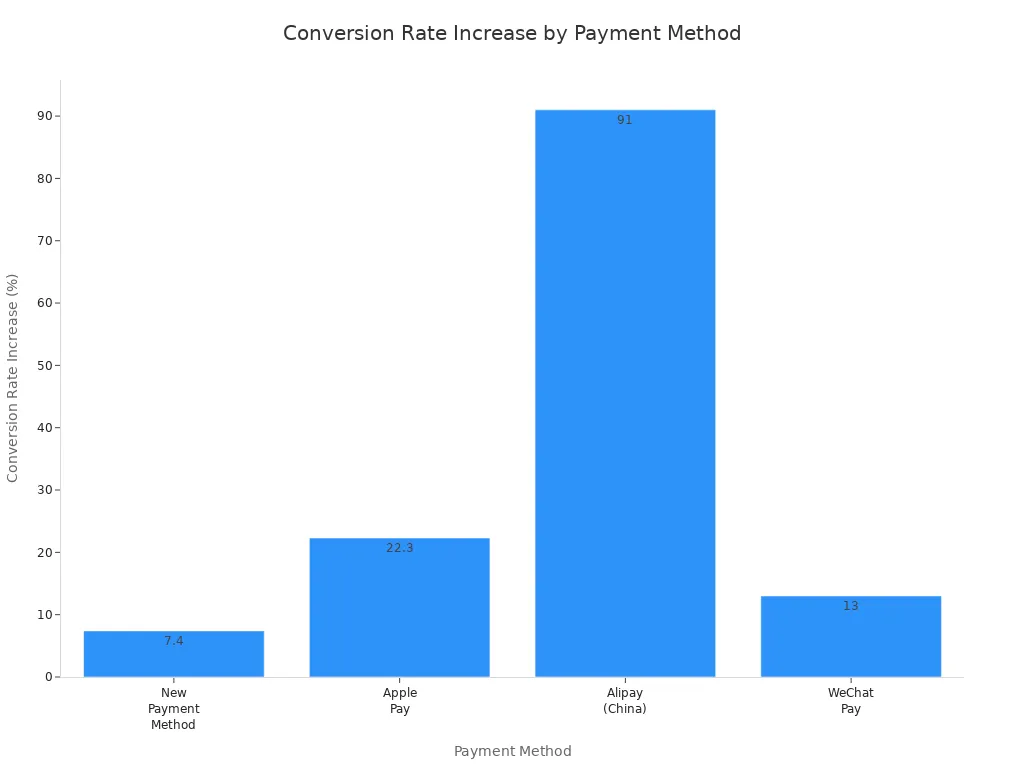

You know how annoying it is when you want to pay but your favorite way to pay is missing. In cross-border e-commerce, payment flexibility is not just nice. It is very important. When you give choices like PayPal, Apple Pay, or Alipay, you make shopping easier. You help more people finish buying things. Look at how different payment methods help more people buy:

Payment Method | Conversion Rate Increase | Revenue Increase |

|---|---|---|

New Payment Method | 7.4% | 12% |

Apple Pay | 22.3% | 22.5% |

Alipay (China) | 91% | N/A |

WeChat Pay | 13% | 14% |

You may want to let your customers pick from more ways to pay. But using many payment systems can be hard. You need to think about how to set them up, keep them safe, and follow the rules. The good news is there are smart ways and real stories that show you how to do it.

Key Takeaways

Giving many payment choices helps customers trust you. It also helps you sell more. When shoppers have choices, they feel safe. They are more likely to buy things.

Knowing what payment people like in each place is important. People in different areas like different ways to pay. Change your payment choices to fit what people want.

Payment orchestration platforms make it easier to handle many payment ways. These tools help make checkout simple. They also stop customers from getting confused.

You need to keep things flexible but also simple. Too many payment choices can make shoppers feel lost. Pick the most used payment ways for your shoppers.

Check what payment choices your customers want often. Use data to see what payment ways they like. Change your payment choices to match what they want.

Payment Flexibility in Cross-Border E-Commerce

Boosting Conversion and Customer Trust

Shopping online from another country can feel scary. You want to pay in a way you know. When a store gives you more ways to pay, you feel better. It is not just about having choices. It helps you trust the store more. You are more likely to finish buying.

Many people worry about fraud when paying online. You are not the only one. Most shoppers want strong security for cross-border payments. Here are some facts:

88% of shoppers want strong fraud checks for cross-border payments.

Two out of three people stopped a payment because it did not feel safe.

People want checkout to be simple and fast. They want clear timelines and many payment options.

When you see your favorite way to pay, you feel safe. You know the store cares about you. This trust helps more people finish buying. Stores that offer digital wallets, credit cards, and local methods get more sales. You have an easier time shopping. The store gets more happy customers.

Meeting Local Payment Preferences

Every country has its own favorite ways to pay. If you sell to other countries, you need to know what people like. Some use digital wallets. Others use bank transfers or credit cards. Here is how payment habits change by region:

Region | Payment Method | Percentage of Transactions |

|---|---|---|

Asia | Digital Wallets | |

Europe | Bank Transfers | 36% |

North America | Credit Cards | 70% |

Digital wallets are very popular in Asia. In North America, most people use credit cards. In Europe, many like bank transfers. If you only offer a few ways to pay, you may lose customers. People will leave if they cannot use their favorite way.

Here are some local payment methods people want in different places:

Region | Payment Methods |

|---|---|

Southeast Asia | |

Latin America | PIX, Boleto Bancário, CoDi, Mercado Pago |

To reach more people, you need to support these local ways to pay. Many people in Brazil use PIX or Boleto Bancário. In Mexico, CoDi and OXXO are common. In Argentina and Colombia, many use Mercado Pago.

Tip: If you do not offer local payment options, people may leave their carts. They want to use their own credit cards or e-wallets. Giving them more ways to pay helps you win in cross-border e-commerce.

When you let people pay how they want, you show you care. You help them shop their way. This makes your store special and brings people back.

Challenges of Integrating Multiple Payment Methods

Technical and Operational Complexity

Adding many payment methods to your store can get tricky fast. Each new payment gateway takes weeks to set up and test. This makes your checkout process feel broken up. Shoppers see different screens and steps. This can make fewer people finish buying.

Here’s what you might face:

Challenge | Description |

|---|---|

Every new payment method adds 3–6 weeks to your timeline. | |

Disjointed checkout | Different payment flows confuse shoppers and hurt conversion. |

Separate reports make month-end closing a headache. | |

Rising maintenance costs | Updates and support for each provider drive up costs. |

Technical fragmentation | APIs and SDKs vary, causing delays and more work. |

UX inconsistency | Inconsistent checkout experiences damage trust. |

Reporting issues | Multiple portals slow down financial reconciliation. |

Compliance overload | Unique checks for each method complicate fraud control. |

Operational maintenance | Evolving APIs mean more DevOps hours and higher costs. |

You also have more work to do every day. Handling many payment methods means more problems with reports. Settlement can be slow because each provider uses different systems. You spend extra time fixing mistakes and finding money. You must also follow many rules. These rules change often and are different in each country.

Tip: If your settlement systems are not connected, moving money is slow. You may not see all your payments right away. This can make fees go up.

User Experience and Compliance

You want checkout to be easy for your customers. Too many payment choices without good planning can make things confusing. Shoppers may wait longer and pay more. This can make them upset and leave your store.

User experience gets worse if there are too many payment options and no good plan. Things get slow and cost more. Customers may not be happy.

Did you know that almost all shoppers who have trouble buying will not come back? You need to fix problems that make people leave their carts. More payment choices mean more things to manage. This makes it harder to keep checkout fast and clear.

Following the rules is also hard in cross-border payments. Each country has its own laws. You must check who your customers are and watch for bad activity. You need to keep records for years. Your team must learn the rules and pass audits. Here’s a table to show what you need to do:

Compliance Requirement | Description |

|---|---|

Different countries have unique regulations. Staying compliant takes time. | |

Know Your Customer (KYC) | Always verify the identities of senders and receivers. |

Monitor Transactions | Use software to spot suspicious activities. |

Regular Audits | Conduct audits to meet local and international laws. |

Training | Make sure your team knows the latest rules and red flags. |

Record-keeping | Keep detailed records for at least five years. |

You must give payment choices but keep checkout simple. If you don’t, you could lose shoppers and have trouble with the rules.

Solutions for Multiple Payment Providers

Payment Orchestration Platforms

You want your customers to have more ways to pay. Adding many payment methods can get confusing. Payment orchestration platforms make this much easier for you. These platforms let you control all your payment providers in one place. Every shopper gets the same checkout, no matter where they live.

Here’s how payment orchestration helps:

You manage all payments from one dashboard.

The platform picks the best provider for each payment.

You can add new gateways without changing your whole checkout.

You get access to many banks and local providers.

The system shows customers their favorite ways to pay.

Payment orchestration platforms help you get more sales. They lower your fees by picking the cheapest way to process payments. You also get strong fraud prevention and tools to follow the rules. These platforms use tokenization and end-to-end encryption to keep payment data safe.

Let’s see what features top payment orchestration platforms have:

Feature | Description |

|---|---|

Keeps data safe and meets PCI DSS rules. | |

Seamless API Integration | Connects easily with your systems for a smooth checkout. |

Improved Conversion Rates | Helps more people finish buying with a simple checkout. |

Lower Transaction Costs | Saves money by picking the best payment route. |

Enhanced Security | Watches for fraud and protects your data. |

Increased Efficiency | Automates payments and cuts down on mistakes. |

Greater Flexibility | Lets you add new ways to pay and sell in more places. |

Currency Conversion Optimization | Shows real-time currency rates for shoppers. |

Regional Payment Method Preferences | Changes checkout for local payment habits. |

Supporting Regional Payment Gateways | Works with local banks and other payment methods. |

Advanced Fraud Prevention | Uses AI to stop fraud in cross-border payments. |

You want checkout to be easy. Payment orchestration gives you one checkout, even with many payment providers. You can offer digital wallets, credit cards, and local payment methods together. This makes your store better for shoppers everywhere.

Fishgoo uses payment orchestration to offer global payment options. You can pay with PayPal, Visa, MasterCard, Alipay, and many local ways. You do not need a special bank account or phone number. Fishgoo’s system gives you a smooth payment flow and keeps your data safe with AI, tokenization, and encryption.

Local acquiring is also important for payment orchestration. Local acquirers help you avoid foreign payment problems. This means more payments get approved. You can see approval rates go up by 5-15% or more. Local acquirers know what people in their area like to buy, so payments work better.

Real-time currency conversion matters too. Most shoppers want to pay in their own money. If you only show prices in U.S. dollars, some people will leave. When you offer real-time currency conversion, you build trust and make shopping easier. Customers see the exact price they will pay.

Tip: If you want to sell in new countries, payment orchestration platforms help you do it fast. You do not need to build new systems. You just add the payment methods your customers want.

Unified APIs and Smart Routing

You want to make adding payment methods easy. Unified APIs give you one way to connect with many payment providers. You do not have to learn a new system for each provider. You get one interface for everything. This makes adding payment gateways much easier.

Here’s what unified APIs do:

Key Point | Explanation |

|---|---|

Consistent Interface | You use the same way to talk to all providers. |

Reduced Integration Hassle | You skip the trouble of learning many APIs. |

Easier Maintenance | You only need to fix one connection, not many. |

Enhanced Security | You get strong security for all payment methods. |

Unified APIs let you offer more ways to pay. You can add digital wallets, credit cards, and local payment options. This helps you get more sales and reach shoppers everywhere. You get a checkout that feels the same for everyone.

Smart routing is another tool that helps with cross-border payments. The system checks real-time data and sends each payment to the best provider. This helps more payments go through and fewer get declined. You get better risk control and happier customers.

Here’s how smart routing helps:

Sends payments to the provider with the best success rate.

Makes things run smoother by cutting down failed payments.

Uses real-time data to spot risks and stop fraud.

Works for both repeat and one-time payments.

Fishgoo’s platform uses unified APIs and smart routing for smooth payments. You can add many payment providers and give every shopper the same checkout. You get flexible payment methods, local acquiring, and real-time currency conversion. This helps your store grow around the world.

Note: If you want more payment choices and a simple checkout, look for platforms with unified APIs and smart routing. You will save time, make fewer mistakes, and keep your customers happy.

Adding many payment methods does not have to be hard. With payment orchestration, unified APIs, and smart routing, you can manage many payment providers and give your customers the checkout they want. You get more sales, lower fees, and a store ready for cross-border payments.

Real-World Use Cases in Cross-Border E-Commerce

Fishgoo’s One-Stop Shopping Experience

Fishgoo gives you more than just Chinese products. You get a simple shopping trip from start to finish. Fishgoo lets you pick how you want to pay. You can always use your favorite way. This makes shopping easy and helps you feel safe.

Feature | Description |

|---|---|

Payment Options | Fishgoo lets you pick how you want to pay. |

Security | Safe payment methods help you trust the store. |

You can check your order by yourself. Fishgoo has tools to see updates anytime you want. If you have questions, the FAQ can help you find answers fast.

Fishgoo has tools so you can track your order.

You can see updates whenever you want.

The FAQ helps you get answers quickly.

Fishgoo shows you where your order is at every step. You do not have to guess or worry. The platform keeps you updated, so you feel sure about your delivery.

Fishgoo’s payment system means you do not need a special bank account or phone number. You just pick your favorite way to pay and finish your order. This makes cross-border shopping easy and not stressful.

Other Industry Examples

You are not the only one who wants more ways to pay. Many companies now let people use different payment methods. Here are some examples:

Thunes works with Visa Direct. This lets businesses send money to over 1.5 billion digital wallets in 44 countries. It makes paying people in other countries easier.

Big online stores let you pay with local wallets, credit cards, or bank transfers. This helps more people finish their orders.

When you see your favorite way to pay, you feel ready to buy. Companies that offer many payment methods grow faster and keep more customers happy. Payment gateway integration helps them reach new places and build trust.

Actionable Steps for Expanding Payment Flexibility

Assessing Customer Payment Needs

You need to make sure your payment options work for your customers. First, look at who is shopping at your store. Group your customers by country, age, or how they shop. Use data to find out which payment methods they like most. Try new payment options with a small group before giving them to everyone. Tell your customers how payments work. If you add things like faster shipping or easy returns, your store gets even better.

Here’s a simple checklist to help you begin:

Find out what payment problems you have.

Group your customers and see their favorite ways to pay.

Use tools to guess which payment terms are best.

Start with a small group and then add more people.

Explain payment terms and teach your shoppers.

Choosing and Integrating Payment Providers

Choosing the right payment partners is very important. Pick providers that work in many countries and use many currencies. Make sure they have strong security and easy payment gateway integration. You want payments to be fast and fees to be clear. Check if they let you use digital wallets and local payment methods. Good providers have simple APIs, so you can add them easily.

When you add more payment methods, think about:

Can it grow for global sales?

Does it work with many currencies?

Is it safe and does it follow rules?

Are the costs clear?

Are the APIs easy for developers?

Platforms like Fishgoo help you reach more shoppers around the world. You can offer many payment methods, like digital wallets, credit cards, and even recurring payments, all in one place.

Balancing Flexibility and Simplicity

You want to give shoppers choices but keep checkout easy. Too many options can make people confused. Focus on the payment methods your customers use the most. Use AI to suggest the best way to pay for each shopper. Offer guest checkout to make things faster.

Strategy | Benefit |

|---|---|

Multiple Payment Options | More people finish buying |

AI-Powered Personalization | Fewer people leave their carts |

More trust and more repeat shoppers |

When you mix many payment methods with a simple checkout, you build trust and get more sales. Fishgoo helps you do this by letting you manage everything from one dashboard.

You know how much easier shopping feels when you can pay your way. Adding more payment options helps you reach new customers, boost sales, and keep people coming back. Here’s what you gain:

You attract a wider audience and make checkout smoother.

You increase conversion rates and build loyalty.

You speed up payments and keep your business strong.

Ready to level up?

Check which payment methods your customers want.

Pick providers with clear fees and fast service.

Blend different rails for better results.

Build compliance into your process from the start.

Payment flexibility isn’t just a feature—it’s your edge in global e-commerce.

FAQ

How do I know which payment methods my customers want?

You can check your order data and ask your customers. Try a quick survey or look at what payment options get used most.

Tip: Start with the top three methods your shoppers pick.

Can I add new payment methods without changing my whole checkout?

Yes! Use a payment orchestration platform or unified API. These tools let you add or remove payment methods fast.

No need to rebuild your checkout

You save time and money

Why does local payment matter for cross-border sales?

People trust what they know. Local payment methods help shoppers feel safe.

Region | Popular Method |

|---|---|

Asia | Alipay, WeChat |

Europe | SEPA, iDEAL |

Latin America | PIX, OXXO |

What if a payment fails during checkout?

If a payment fails, your system can try another provider right away. This is called smart routing.

You keep more sales and your customers stay happy.

See Also

Diverse Payment Options Like PayPal And Credit Cards

Enhancing Cross-Border E-Commerce Logistics For Worldwide Success

Simplified Shopping Solutions For Chinese E-Commerce Purchases Abroad

Five Compelling Reasons To Select Fishgoo For Shopping

Leading Proxy Shopping Platforms For International Consumers