Global payment channels made easy, pros and cons explained

You get quick and easy access to markets in other countries with global payment channels. But you also deal with problems like hard rules and money risks. Businesses and shoppers like you use global payment channels to keep up with fast online shopping growth. In 2023, cross-border payments were almost US$190 trillion. This shows how important smooth payments are now. Platforms like Fishgoo make global payment channels easier. They let you pay with ways you already know. This removes problems that often bother cross-border shoppers. When you look for new things and markets, global payment channels help you shop, pay, and get your items safely.

Key Takeaways

Global payment channels help you shop from other countries. They make it easy and safe to buy things. You can pay in your own currency. Sellers get their money without any trouble.

Platforms like Fishgoo let you pick payment methods you know. You can use PayPal or credit cards. This makes paying simple. You do not have to worry about hard payment systems.

Global payment methods are fast and have lower fees. They are cheaper than regular banks. You can save money and get your orders sooner.

Watch out for hidden fees and currency risks. Always check the total cost before you pay.

Security is very important when you shop online. Pick payment methods that protect you from fraud. This helps keep your money safe.

What are global payment channels?

Definition

Global payment channels help you send money from one country to another. These channels connect buyers and sellers who live in different parts of the world. You can use them to pay for goods or services in a way that feels safe and easy. They play a big role in cross-border payments. When you shop online from another country, these channels let you pay in your own currency. The seller gets paid in their currency. This makes shopping from other countries possible for everyone.

Platforms like Fishgoo use global payment channels to make your shopping experience smoother. You do not need a local bank account or a special payment app. You can use familiar payment methods, such as PayPal or credit cards. This helps you buy products from China without any trouble.

How they work

When you use a global payment channel, several steps happen behind the scenes. The process may look simple to you, but it involves many important actions:

The payment system converts your money into the seller’s currency. This means you do not have to worry about exchange rates.

Merchants choose payment methods that match what people in each region like to use. For example, you might use a credit card, while someone else uses a digital wallet.

The system adds security checks to protect your money. Fraud protection keeps your payment safe, even when you shop from far away.

Fishgoo brings all these steps together. You only need to paste a product link and choose how you want to pay. The platform handles the rest, including payment, currency conversion, and security. This makes cross-border payments simple and stress-free for you.

Pros of global payment channels

Speed and efficiency

You want your money to move quickly. Global payment methods help you send money almost right away. Old bank transfers can take a few days. Newer ways, like account-to-account payments, send money fast. This helps your orders get processed sooner. Fishgoo uses these fast channels, so you do not wait long. You see your payment finish right away. This makes shopping less stressful.

Global reach

You can shop from almost anywhere in the world. Global payment methods let you pay sellers in other countries easily. You do not need to worry about different money or banks. Fishgoo supports many ways to pay, so you can pick what you like. This helps you find special products and new places to shop.

Here is a table that shows how global payment channels help you:

Factor | Description |

|---|---|

Geographic Reach | Lets you buy and sell in many countries and use different currencies. |

Transaction Volume | Handles many payments at once, which is good for busy shoppers and businesses. |

Payment Methods | Gives you choices like credit cards, digital wallets, and bank transfers. |

You can trade with people in other countries. You also get to use global online payment processing. This opens up new markets for you.

Cost savings

You save money when you use global payment methods. These channels often cost less than old banks. You avoid hidden fees and get better exchange rates. Fishgoo shows you the exchange rate right away, so you know what you pay. You can also put many orders together in one shipment. This lowers your shipping costs. This helps you keep more of your money.

Convenience and accessibility

You want shopping to be easy. Global payment methods make it simple to pay your way. You can use PayPal, Visa, MasterCard, or local options. Fishgoo lets you pick what works best for you. You do not need a special bank account or a local phone number.

Global payment channels offer local payment methods for different regions.

You get more choices, even if you live where banks are few.

Digital payment methods help people in far places shop online.

Tip: In Southeast Asia, many new shoppers use other payment methods because credit cards are not common. Businesses that know what people like to use sell more and keep customers happy.

Digital payment systems have changed how people shop. This is true in places where banks are hard to reach. Mobile wallets and instant payments let more people shop online. This makes shopping fairer and open for everyone.

Enhanced security

You want your money to be safe. Global payment methods use strong security to protect you from fraud. Fishgoo uses real-time checks and secure systems to keep your payments safe. Here is a table that shows some common security features:

Security Feature | Description |

|---|---|

AI-Driven Fraud Prevention | Finds strange patterns to stop fraud before it happens. |

Tokenization | Hides your real payment data with special codes. |

End-to-End Encryption (E2EE) | Locks your payment data from start to finish. |

Real-Time Transaction Monitoring | Watches every payment for signs of trouble. |

You also get help from payment partners who know the rules and keep your data safe. This means you can shop with confidence, knowing your information is protected.

Note: Ongoing transaction monitoring and multi-factor authentication add extra layers of security to every payment.

Global payment methods give you speed, reach, savings, convenience, and security. Fishgoo brings all these benefits together, making your cross-border shopping smooth and safe.

Cons of global payment channels

Regulatory issues

You face many rules when you use global payment channels. Each country has its own laws for electronic payments. You must follow these rules to avoid problems. Some countries want you to store data locally. Others ask for special licenses or strict checks on who sends and receives money. If you do not follow these rules, you can get big fines or lose your right to do business.

Here is a table that shows some of the main regulatory challenges:

Challenge | Description |

|---|---|

Data Privacy and Protection Laws | You must follow rules like GDPR in Europe or DPDPA-2023 in India. These laws require local data storage and have strong penalties. |

Licensing and Registration | You need different licenses in each country to operate legally. |

AML and KYC Requirements | You must check who your customers are and watch for money laundering. Rules change by country. |

Currency Exchange Risks | Some countries limit how much money you can send or receive. |

Tax Compliance and Reporting | You must report payments and pay taxes in each country. Mistakes can lead to big penalties. |

Note: You also need to keep up with changing rules. Many countries update their laws often, so you must stay alert.

Currency risks

When you send money across borders, you deal with different currencies. The value of money changes every day. This can make your payments cost more or less than you expect. If you run a business, these changes can hurt your profits. If you send money to family, you might not know how much they will get.

Currency changes can also affect when you choose to pay. You might wait for a better rate, but this adds stress and makes planning harder. You need to watch the market and act fast, which is not always easy.

Technical barriers

You may find it hard to connect your systems to global payment channels. Many businesses use old technology that does not work well with new electronic payments. You might need to spend money to upgrade your systems. This can take time and cause delays.

Here is a table that shows some common technical barriers:

Barrier Type | Description |

|---|---|

Compatibility Issues | Your system may not work with all payment methods or platforms. |

System Interoperability | You need your technology to talk to other systems around the world. |

Gateway Selection Issues | You must pick a payment gateway that is safe, works well, and does not cost too much. |

Many businesses struggle to connect old systems with new payment processing tools.

Upgrading technology can be expensive and confusing.

Tip: Not every supplier or platform supports digital or virtual payments. You may need to check before you buy.

Fees and hidden costs

You may think global payment channels save you money, but hidden fees can add up. Each bank or service in the payment chain may take a fee. You might not see these costs until after you pay. Some banks also add extra charges to exchange rates, making your payment more expensive.

Common hidden costs include:

Intermediary bank fees that you do not see before you pay.

Exchange rate markups that can be 2-5% higher than the real rate.

Charges from the receiving bank that are not always clear.

A 2023 World Bank report says sending $200 can cost over 6% in fees. For businesses, these costs can be even higher. Small businesses in Europe lose up to 53% of their international payment fees to exchange rate markups. Globally, businesses lose up to $2.5 trillion each year because of high fees.

Fraud and security concerns

You want your money to be safe, but global payment channels can attract payment fraud. Criminals look for ways to steal money or trick you. You must use strong security to protect your payments. Some common risks include identity theft, account takeovers, and fake merchants.

Here is a table that shows types of fraud and how you can protect yourself:

Type of Fraud | Mitigation Strategies |

|---|---|

Chargeback Fraud | Check customer details, use fraud protection software, act fast on chargebacks. |

Identity Theft | Train your team, follow PCI DSS rules. |

Account Takeover | Use strong passwords, require two-factor authentication. |

New Account Fraud | Use multifactor authentication, check customer information. |

Merchant Identity Theft | Teach staff about phishing, set up clear communication rules. |

Mobile Payment Fraud | Protect customer data, watch for data breaches. |

General Strategies | Use machine learning to spot fraud, keep your network secure, follow PCI standards. |

Callout: Always use up-to-date security tools and train your team to spot scams. This helps keep your electronic payments safe.

You must stay alert to new threats. Good fraud protection and strong payment processing systems help you avoid losses.

Global payment methods comparison

Table of pros and cons

There are many ways to pay when you buy things from other countries. Each way has good points and bad points. The table below shows the main pros and cons for each popular global payment method. This helps you pick the one that works best for you.

Payment Method | Pros | Cons |

|---|---|---|

Credit cards | Flexible, easy to use, accepted worldwide | Fees, possible interest charges |

Debit cards | Instant access to funds, no need for cash | Risk of overdraft |

Bank transfers | Secure, good for large amounts | Slow processing |

Digital wallets | Fast, contactless, easy for online shopping | Needs compatible devices |

ACH transfers | Low cost for regular payments | Not instant, slower than wires |

Wire transfers | Quick, reliable for big payments | Higher fees |

Cryptocurrency | No borders, transparent, fast | Value changes quickly, rules can be unclear |

Contactless payments | Very fast, convenient, clean | Not accepted everywhere |

Mobile banking apps | Easy to use, real-time updates | Security risks with phones |

Buy now, pay later (BNPL) | Makes shopping affordable, boosts sales | Fees, can affect business cash flow |

When you look at global payment methods, think about speed, cost, and safety. Some ways, like digital wallets and contactless payments, let you pay with just one click. This makes shopping quick and simple. Other ways, like bank transfers, are better for big buys but take more time.

Transaction fees can be very different. Some services have small fees, but others add extra costs for changing money.

Safety is important. Pick ways that use encryption and two-factor authentication to keep your money safe.

How fast your payment goes through matters. If you want your payment to finish right away, choose a method with instant transfers.

Fishgoo is special because it shows you all the payment fees before you pay. You do not get any surprise charges. You can pick from many global payment methods, like local wallets and big credit cards. Fishgoo also lets you send money fast and in many currencies. This makes shopping from other countries easy and clear.

Tip: Always check the payment choices and fees before you finish your order. This helps you avoid surprises and pick the best way to pay for you.

Deciding on global payment channels

Key considerations

When you pick a global payment channel, think about what you need. People, small importers, and businesses care about different things. You want a payment method that is simple and quick to start. Fast payments help you keep your money steady. They also lower the risk from changing exchange rates. If you work with company payments, your system should fit your current financial tools.

Here are some things to think about:

Operational simplicity: Choose a payment channel that is easy to use.

Fast settlement: Pick ways that move money quickly.

Regulation and compliance: Follow all local laws and rules.

Data transparency: Find clear info about fees and times.

Risk and resilience: Pick safe and strong payment options.

Customer experience: Give customers payment choices they like.

Interoperability: Make sure your payment works with your systems.

Processing costs: Know all the fees before you choose.

Access to insights: Use payment data to make smart choices.

You should also check payment security, which currencies are supported, and if the channel works with platforms like Fishgoo. The table below explains why these things matter:

Feature | Description |

|---|---|

Keeps your payments safe and helps customers trust you. | |

Supported Currencies | Lets you take payments in many currencies for global sales. |

Platform Integration | Makes it easy to connect with your tools and workflow. |

Practical tips

You can make better choices by following some easy tips. If you handle company payments, hire experts who know your main markets. Use simple words when talking to customers. Give payment help in different languages for people from many places.

Use AI to automate payments and save time.

Try digital payment options like wallets and account-to-account transfers.

Check all costs to avoid hidden fees before you pay.

Give local help and explain payment terms clearly.

Keep your payment system updated to stop fraud.

Tip: Always put your customers first by making payments simple and safe. This helps you build trust and grow your business.

Virtual payments and the future

Trends

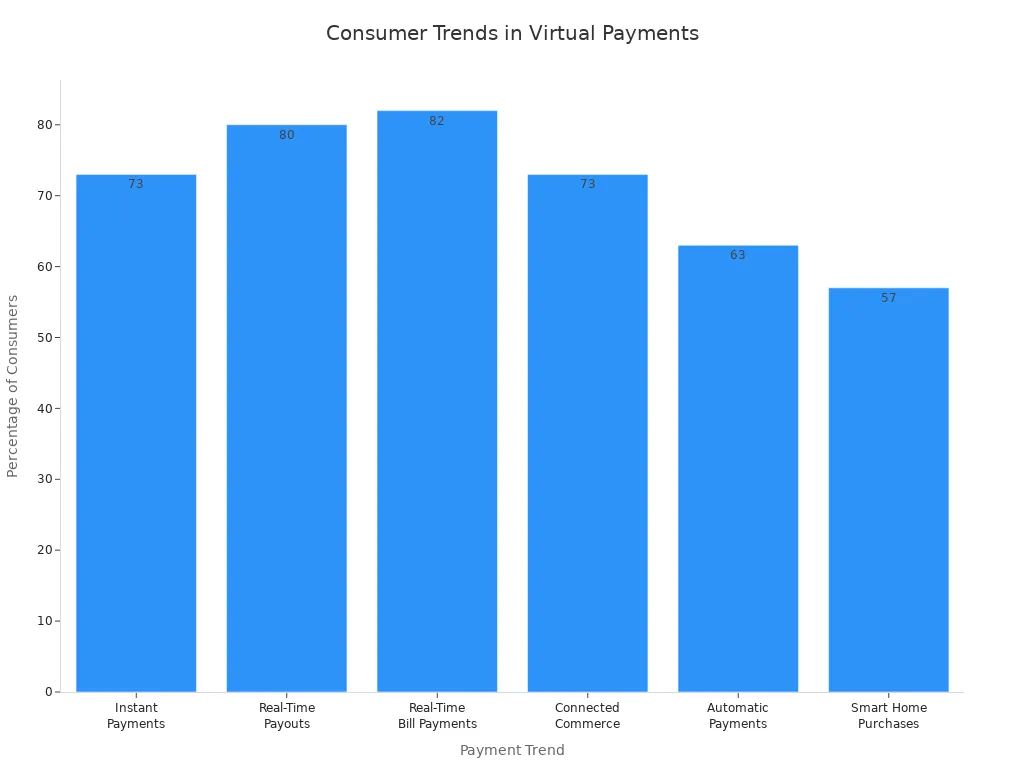

Virtual payments are changing how people buy things everywhere. More people now use instant payments and real-time bill pay. About 73% of people already use instant payments. Around 82% want to pay bills that show up right away. You can use your phone or smart home devices to shop. This makes buying things faster and easier.

Many businesses now take cryptocurrency and use blockchain for payments. This helps you send money quickly and safely. Stores also try to build trust by making payments clear and easy to understand. Juniper Research says digital commerce will grow from 23 trillion in 2025 to 34.5 trillion by 2029. This means virtual payments will become even more important for shopping around the world.

Trend | Statistic | Description |

|---|---|---|

Instant Payments | 73% | Consumers have adopted instant payments. |

Real-Time Payouts | 80% | Want payouts from businesses in real time. |

Real-Time Bill Payments | 82% | Want to pay bills instantly. |

Connected Commerce | 73% | Comfortable using tap-to-pay cards or phones. |

Automatic Payments | 63% | Interested in automatic payments when leaving a store. |

Smart Home Purchases | 57% | Interested in buying with smart home devices. |

Note: Platforms like Fishgoo follow these trends by adding new ways to pay and making checkout simple for you.

Opportunities

Virtual payments give you and businesses new chances. You can shop from anywhere and pay in just seconds. Businesses can find more customers and sell in new places. Many companies now use real-time payments and embedded payments to make things easy for you.

Payment Technology | Benefits for Businesses | Benefits for Consumers |

|---|---|---|

Buy Now, Pay Later (BNPL) | Flexible payments, more sales | Easier to buy, larger purchases |

Embedded Payments | New revenue, better customer engagement | Quick, easy payments |

Cross-Border Payments | Access to global markets | Seamless international shopping |

Real-Time Transactions | Faster operations, instant funds | Engaging, immediate payments |

By 2030, 74% of digital payments will use non-financial companies.

Over half of fintech companies think cross-border payments will help them grow.

63% of people already use real-time international payment services.

You get more choices and faster service from these changes. Businesses can save money and keep customers coming back. Virtual payments will keep growing, and platforms will keep changing, making shopping worldwide easier for everyone.

You know global payment channels help you send money fast. They also let you pay less in fees and get good exchange rates. But sometimes, you cannot send large amounts. Some currencies are not supported.

Pros | Cons |

|---|---|

Lower fees | Transfer limits |

Faster transfers | Not all currencies supported |

Better exchange rates |

If you shop or run a business in other countries, pick a payment solution that fits your needs. Look for one that is quick, safe, and shows all fees clearly. Try platforms like Fishgoo to make payments easier. You can find guides to help you with currencies, rules, and smart ways to use global payments.

FAQ

What is a global payment channel?

A global payment channel lets you send money to sellers in other countries. You can pay in your own currency. The seller gets paid in theirs. This makes international shopping easy for you.

How do you choose the best payment method?

You should look for speed, low fees, and strong security. Pick a method that works in your country. Check if the platform, like Fishgoo, supports your favorite way to pay.

Are global payment channels safe?

Most global payment channels use strong security. You get protection from fraud and data theft. Always use platforms that offer encryption and real-time monitoring.

Can you use local payment methods on Fishgoo?

Yes, you can. Fishgoo supports PayPal, Visa, MasterCard, and many local options. You choose the one that fits you best.

What should you do if your payment fails?

Try another payment method. Check your card or account balance. Contact customer support for help. Fishgoo’s team can guide you step by step.

See Also

Exploring Various Payment Options Like PayPal And Credit Cards

Key Global Shipping Solutions For Newbies In 2025

FISHGOO Review: Advantages, Disadvantages, And Service Quality Insights

Shopping Online From China: Best Platforms And Shipping Tips For 2025