Understanding Total Cost When Importing Goods into the EU

You want to bring goods into the EU, but you need to know all the costs. Extra fees can make a good deal go bad. Fishgoo’s one-stop cross-border shopping service helps you make things easier and control spending.

Knowing your total cost helps you plan your money and avoid surprises.

Use tools and resources so you can guess costs with confidence.

Key Takeaways

Find out the full cost when you import goods. This means you need to add product price, shipping, duties, taxes, and other fees. Knowing all these costs helps you not get surprised later.

Use the right HS code for your products. The HS code decides what duties and taxes you pay. If you use the wrong code, you may face delays and pay more fees.

Look up customs rules and VAT rates for your goods. Every EU country has its own rates. Knowing these rates helps you plan your budget well.

Think about shipping consolidation to save money. If you group shipments, you can pay less for transportation. It also makes customs clearance easier.

Try tools like Fishgoo’s shipping calculator. These tools help you guess costs and make smart choices before you import.

What Is Total Cost for EU Imports

Definition and Components

It is important to know what makes up the total cost when you import goods into the EU. The total cost is everything you pay to get your products to your home. This includes the price of the goods, shipping, taxes, duties, insurance, and other fees. Each part adds up and changes what you pay in the end.

Here is a table that lists the main parts:

Component | Description |

|---|---|

The final price for an international order, including products, duties, taxes, and fees. | |

These are not the only costs; you may also pay fees from shipping carriers, brokers, and customs. | |

These are the costs to move goods to your country. | |

Cargo Insurance Costs | Insurance helps protect your goods if they get lost or damaged during shipping. |

Other Fees | These are extra charges that can come from government agencies or customs. |

You also need to think about customs valuation. Customs officers look at the value of your goods to decide how much duty you pay. They usually take a percentage of the total value. This step is important because it sets the starting point for other costs.

Different goods can change your total cost. For example:

If there is a lot of local supply, you may pay less because there are many choices.

If local supply is enough, tariffs can make prices higher and make imports less popular.

If there is little or no local supply, tariffs can make it harder to get what you need.

Other things matter too:

The type of product can mean higher taxes for some items.

Where you buy from matters because fees change by country.

Country rules affect tax rates and trade deals.

In 2024, machinery and transport equipment made up 33% of all goods imported into the EU. This shows these products are very important in the total cost.

Tip: Always check the customs rules for your product and where it comes from. This helps you avoid surprises and plan your money.

Why Total Cost Matters

You need to know the total cost before you import anything. If you miss a fee or tax, you could lose money. Not counting EU tariffs can make your profits smaller. If you guess costs wrong, you might get surprise bills. You may have to pay more or raise your prices, which can make your products harder to sell.

Here are some risks if you do not figure out your total cost:

You could get penalties or delays if you use the wrong tariff code.

New import tariffs can change the market and affect your future money.

Surprise costs can make you lose money or make your customers pay more.

Note: Calculating costs the right way protects your business and helps you compete in the EU.

You can avoid these problems by using tools and services that help you guess your total cost. Fishgoo’s platform shows you clear fees and real-time exchange rates. You can use shipping and duty calculators to plan ahead.

When you know your total cost, you can make smart choices, set good prices, and grow your business in the EU.

Main Cost Elements

Import Duties

You pay import duties when you bring goods into the EU. These charges depend on what you import and how much it is worth. Machinery, electronics, and mineral fuels usually cost the most to import. The table below shows which groups add the most to the total cost for EU imports:

Value (in Billion USD) | |

|---|---|

Mineral fuels, oils, distillation products | 504.85 |

Electrical, electronic equipment | 363.49 |

Machinery, nuclear reactors, boilers | 302.92 |

Import duties can change your total cost fast. You should check the duty rate for your product before you buy it.

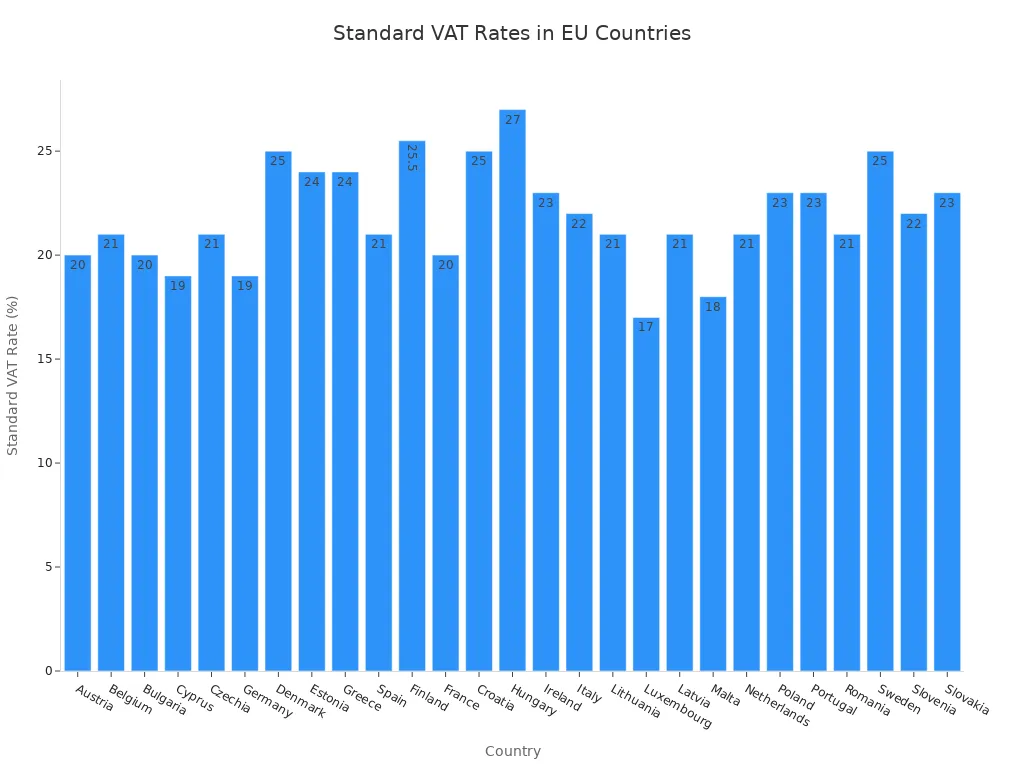

VAT and Taxes

You have to pay VAT on all goods that come into the EU. Each country picks its own VAT rate. The rate depends on where your goods are sent. The table below shows the standard VAT rates for each country:

Country | Standard VAT Rate |

|---|---|

Germany | 19% |

France | 20% |

Spain | 21% |

Italy | 22% |

Sweden | 25% |

Hungary | 27% |

Tip: VAT is set by the country where your goods arrive. You must pay VAT even for small packages.

Shipping Fees

Shipping fees change based on distance, weight, size, and cargo type. Air shipping costs more than ocean shipping. Fuel prices and busy ports can also raise shipping costs. The table below shows the main things that affect shipping fees:

Factor | Description |

|---|---|

Distance | Longer trips cost more money. |

Weight and Volume | Heavier or bigger items cost more to ship. |

Mode of Transportation | Air shipping is pricier than ocean shipping. |

Insurance | Expensive goods need extra insurance. |

Fishgoo helps you save on shipping by putting packages together and giving you more shipping choices.

Customs and Handling Charges

You pay customs clearance fees when your goods enter the EU. These fees pay for paperwork and checks. Most packages have a €2 handling fee for admin costs. You pay these fees on top of duties and VAT. The importer of record must pay these costs.

Note: Customs and handling fees can change depending on the port and shipping route.

Value-Added Services

Value-added services like warehousing and repackaging help you with your shipments. Fishgoo gives you free package grouping, quality checks, and flexible storage. These services can lower your total cost by letting you ship many items together and wait to pay duties until you sell the goods. You also get better control of your stock and protection from market changes.

Fishgoo’s service mixes shipping, warehousing, and value-added services to help you save money and avoid surprises.

Total Cost Calculation Steps

You need to know every step to guess your total cost. This is important when you import goods into the EU. Fishgoo’s order and shipping steps make things easier. You can follow these steps to avoid mistakes and plan your money.

Product Information and HS Codes

First, collect all the facts about your product. You need the product name, what it is, how much it costs, and where it comes from. The HS code is the most important part. Customs uses HS codes to sort goods. This code tells you what duties and taxes you must pay.

HS codes help customs pick the right duty and tax rates.

Using the right HS code stops delays and extra fees.

Correct codes on forms help your goods arrive on time and avoid surprise costs.

Fishgoo’s website helps you fill in product facts and HS codes. You can look at the product page or ask Fishgoo’s team for help if you are not sure.

Tip: Always check your HS code before you send your order. Mistakes can mean higher fees or delays.

Duty and Tax Calculation

After you have your product facts and HS code, you must figure out duties and taxes. Each product has its own duty rate. The country where your goods go picks the VAT rate.

Here is an easy way to guess these costs:

Find your supplier and check the product facts.

Look up the import rules and duty rates for your product. Make sure your goods follow EU rules.

Plan how to move your goods and get ready for customs.

Collect all papers for customs, like invoices and product certificates.

You can use online tools to help with these numbers. The table below lists some helpful tools:

Tool Name | Description |

|---|---|

EU's Official Customs Duty Calculation Page | Figures out customs duties using product value, tariff, and where it comes from. |

CrimsonLogic's Import Duties & Taxes Estimator | Guesses duties and taxes for shipments, so you know costs before you buy. |

Fishgoo’s shipping calculator also shows you duty and tax guesses for your package. You can type in your product facts and see the fees you might pay.

Note: Duty rates and VAT can change. Always check the newest rates before you order.

Shipping and Logistics Costs

Shipping and logistics costs change based on your product, its weight, and how you send it. Air shipping costs more than sea shipping. Insurance and special care add to the price.

The table below shows normal fulfillment costs for different products:

Product Category | Fulfillment Cost (EUR) | Description |

|---|---|---|

Fashion accessories | €3.00–€4.50 | Light and small. Needs careful packing so it does not break. |

Books/media | €2.20–€3.50 | Easy to pack and stack. Cheap to ship with few returns. |

Medical devices | €4.00–€6.00 | Needs clean handling and rules. More complex and costs more. |

Consumer electronics | €6.00–€8.00 | Breaks easily and costs a lot. Needs more insurance and careful work. |

Fishgoo lets you put packages together to save on shipping. You can pick from many shipping ways and add insurance for more safety.

Tip: Use Fishgoo’s shipping calculator to check costs for different shipping ways.

Total Cost Example

Let’s look at an example using Fishgoo’s steps:

You find a supplier for fashion accessories in China.

You paste the product link into Fishgoo and check the facts. Fishgoo helps you fill in the HS code.

You use Fishgoo’s shipping calculator to see the duty rate and VAT for your country.

You pick your shipping way. The calculator shows the cost for shipping, insurance, and any extra services.

You check the total cost. This includes the product price, shipping to Fishgoo’s warehouse, shipping to your country, duties, VAT, and handling fees.

You send your package and pay. Fishgoo does the customs papers and tracks your shipment.

Callout: Always check each cost before you pay. This helps you avoid surprise fees and keeps your money plan safe.

You can use Fishgoo’s calculators and EU customs tools to guess your total cost. This step-by-step way helps you plan, save money, and import goods without problems.

Tools and Resources

When you bring goods into the EU, you need tools to guess your total cost. These tools help you avoid errors and plan your money. You can use calculators, official websites, and Fishgoo’s platform for clear answers.

Import Duty Calculators

Import duty calculators show you how much customs duties and taxes you will pay. You type in your product details, HS code, and where it comes from. The calculator gives you the duty rate and tax estimate. You can use these tools before buying, so you know what to expect.

Popular import duty calculators:

EU Customs Duty Calculator: Type in product value, HS code, and origin to see duty and VAT.

CrimsonLogic Import Duties & Taxes Estimator: Get quick guesses for shipments to the EU.

Tip: Always check results with official sources. Duty rates can change quickly.

Official EU Customs Sites

Official EU customs websites give you the most correct and up-to-date facts. Use these sites to check rules, duty rates, and product types.

Key EU customs resources:

TARIC Database

Find EU customs tariffs and rules.

See daily updates on import rules and costs.

Check all rules for commercial and farm goods.

Learn about product classification systems.

Find duty rates, levies, and other requirements.

See what you need for your product to enter the EU.

Note: These sites help you avoid errors and keep your import process easy.

Fishgoo Shipping Calculator

Fishgoo’s shipping calculator helps you guess your shipping costs. You type in your product details, weight, and where it is going. The calculator shows shipping choices, prices, and discounts. You can also see if insurance is offered for your route.

Benefits of using Fishgoo’s calculator:

Feature | Description |

|---|---|

Multiple shipping lines | Pick the best route for your needs. |

Real-time rates | See current prices and exchange rates. |

Coupon support | Use shipping and value-added service coupons. |

Insurance options | Add protection for valuable or breakable items. |

Fishgoo’s calculator helps you plan your money and avoid surprise fees.

You can use these tools together to see your total cost clearly. This helps you make smart choices and keeps your import process simple.

Compliance and Pitfalls

Documentation Requirements

You must have the right papers to import goods into the EU. If you forget a document, your shipment can be delayed or even sent back. You might also have to pay fines. Fishgoo helps you get all the forms you need. This makes importing easier and faster. Here is a table that lists the main documents and what happens if you do not have them:

Document Type | Description | Consequences of Missing Document |

|---|---|---|

Single Administrative Document (SAD) | Mandatory customs document for trade with the EU. | Delays, fines, refusal of goods. |

Certificate of Compliance (CoC) | Ensures goods meet legal standards. | Refusal of entry, delays, storage charges, potential destruction of goods. |

Air Waybill (AWB) | Required for air shipments. | No entry allowed, delays, fines, reprocessing fees. |

Fishgoo’s online tools help you fill out customs forms the right way. Their team checks your product details and makes sure you follow each country’s rules. This helps you avoid mistakes.

Tip: Always check your papers before you ship. The right documents help your goods move without problems.

HS Code Accuracy

HS codes tell customs what your product is. If you use the wrong code, you might pay too much or wait longer. Customs may stop your goods or ask for more papers. Fishgoo helps you choose the right HS code. They also keep up with new customs rules.

You might pay extra duties if you use the wrong code.

Wrong codes can slow down customs clearance.

You could get a penalty for using the wrong code.

Customs might check your goods and ask for more papers.

Changing the code later takes time and slows your shipment.

The right HS code helps you pay the right amount and get your goods faster.

Note: Always ask Fishgoo’s support to check your HS code before you ship.

Common Mistakes

Many people make mistakes when they figure out the total cost. You might forget extra fees or local taxes. Fishgoo’s platform shows you all the costs so you do not miss anything. Here is a table of common mistakes and what they can do:

Mistake | Description |

|---|---|

Ignoring additional costs | You only look at the product price and forget about shipping, duties, insurance, storage, and broker fees. |

Incomplete cost analysis | Not checking every cost can lead to surprise bills and less profit. |

Overlooking local taxes | Forgetting VAT or other taxes changes your total cost. |

Incomplete landed cost calculation | Missing things like shipping, insurance, and taxes means you might get surprise bills. |

Callout: Use Fishgoo’s calculators and support to check every cost. Good planning helps you avoid surprises and keeps your business safe.

Cost-Saving Tips

Shipping Consolidation

You can save money if you send shipments together. Fishgoo lets you put many orders in one box. This way, you pay less for shipping and customs is easier. You only need to fill out one set of papers. This makes things faster and lowers your fees. You get all your items at the same time. This helps you avoid waiting and keeps your business working well.

Benefit | Description |

|---|---|

Sending shipments together means you pay less for delivery. | |

Unified Customs Clearance | One customs check means less work and lower costs. |

Improved Logistics Efficiency | Getting everything at once makes your work easier. |

Simplified Customs Processes | One customs form is faster and costs less to import. |

You know what you will pay when you send everything together.

It is easier to manage one shipment than many.

Lower shipping costs mean you keep more money.

Tip: Always see if you can send orders together before you ship. This easy step can help you save a lot on your total cost.

Using Coupons and Discounts

Fishgoo gives you shipping coupons and discounts for extra services. You can use these coupons when you pay for shipping or things like stronger boxes. When you sign up with Fishgoo, you get coupons right away. You can also join special events to save even more.

How to maximize your savings:

Use a shipping coupon for every package you send.

Use service coupons when you need extra safety for your goods.

Check your account for new deals before you pay.

Callout: Using coupons and discounts helps you spend less on imports and keep your budget safe.

Insurance and Protection

It is important to keep your goods safe. Fishgoo has different insurance choices for your shipments. You can pick insurance for damage, loss, or theft. There is motor truck cargo insurance for accidents and theft. Marine insurance protects your goods on ships or planes. Liability insurance pays for legal costs if your goods hurt someone. Customs bond insurance helps you follow customs rules. Export credit insurance helps if buyers do not pay you.

Motor truck cargo insurance pays for accidents and theft.

Marine insurance protects expensive goods on ships or planes.

Liability insurance pays if your goods cause harm.

Customs bond insurance helps you follow customs rules.

Export credit insurance helps if buyers do not pay.

Political risk insurance pays if you lose goods in unsafe places.

Note: If tariffs go up, your insurance value goes up too. This can make your insurance cost more. Always pick the right insurance for your shipment.

Actionable tips for lowering costs:

Keep a full list of your imports to stop extra charges.

Make sure your partners give the right info to avoid delays.

Give enough time for checks so you do not pay extra fees.

Use tech like EDI to make customs faster.

Get your own security bond to save money on fees.

Tip: Check your import info often. Teach your team and change your plans when rules change. Good planning helps you save money every time you import.

You can keep import costs low by following easy steps. First, check your product facts and use the right HS codes. Fishgoo’s service lets you group shipments and use coupons to save money. Try these smart ideas:

Learn trade rules to get better prices.

Use local assembly to save both time and cash.

Pick shipping ways that cost less.

Helpful tools make your work simple:

Feature | Description |

|---|---|

Ease of Use | Easy to use for fast cost checks. |

Customs Compliance | Follows customs rules for safe importing. |

Extensive Inventory | Over 20 million items for good results. |

Tip: Check your plan often and use Fishgoo’s help for easy EU imports.

FAQ

What is the total landed cost when importing into the EU?

You pay the total landed cost. This includes the product price, shipping, import duties, VAT, and any extra fees. You must add all these costs to know your real expense.

How do I find the correct HS code for my product?

You can check the product description or ask Fishgoo’s support team. You can also use the EU TARIC database. The right HS code helps you avoid delays and extra charges.

Do I need to pay VAT on every import?

Yes, you must pay VAT on all goods entering the EU. The VAT rate depends on the country where your goods arrive. Check the rate before you order.

Can I use Fishgoo to combine shipments and save money?

Yes! Fishgoo lets you group many orders into one parcel. This helps you pay less for shipping and makes customs clearance easier.

What documents do I need for EU customs clearance?

You need the invoice, HS code, and shipping documents. Sometimes, you need certificates for special goods. Fishgoo helps you prepare all required paperwork.

See Also

Maximizing Your International E-Commerce Logistics For Success

Understanding International Shipping Costs And Options From China

Top Shipping Options From China To Spain: Costs And Customs

Calculating Your Shipping Expenses With FISHGOO

Utilizing Fishgoo's Calculator For Precise Shipping Cost Estimates